Table of Contents

Special Decision for Government Officers

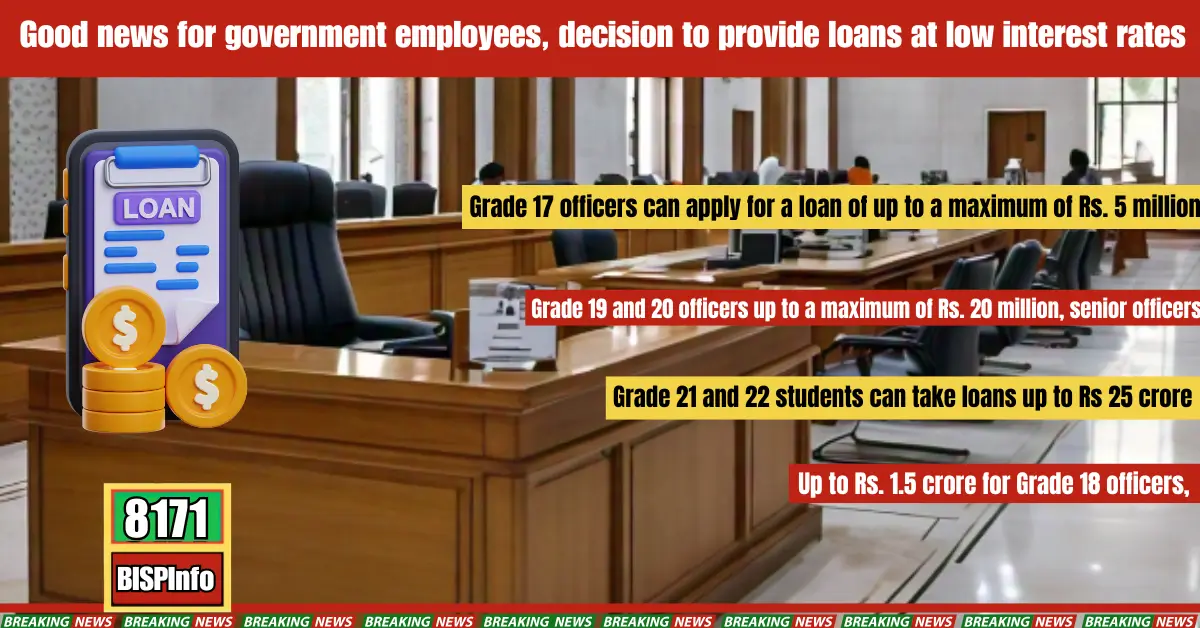

Special Decision for Government Officers for officers of Pakistan Administrative Services (PAS) and Provincial Management Service (PMS), under which they can get loans at just a 2 percent markup. This scheme is an important step to provide support to government officers as per their financial needs. A committee has been formed in this regard, headed by Finance Secretary Mujahid Sherdil, to complete the project effectively and ensure easy provision of loans to the officers.

The loan limit has been fixed according to the grade of the officers, in which Grade 17 officers are eligible for loans up to Rs 5 million, Grade 18 officers up to Rs 1.5 crore, Grade 19 and 20 officers up to Rs 2 crore, and senior officers of Grades 21 and 22 up to Rs 25 crore. This scheme is an excellent opportunity for those officers who want to meet their financial needs at a low markup and want to take advantage of this facility provided by the government.

Benazir Income Support Program: Utility Stores Corporation Benefits Discontinued

This initiative is a major source of financial assistance for officers, which will not only meet their current needs but will also be helpful in their future financial planning. This scheme is an expression of the government’s commitment to provide all possible facilities to government officers so that they can discharge their responsibilities in the best possible manner.

Also Read: Official Launch of the Punjab Socio-Economic Registry (PSER) Project

Loan Scheme Details

According to sources, the government has formed a dedicated committee led by Finance Secretary Mujahid Sherdil to finalize the details of this program. The scheme is tailored to meet the financial needs of officers, with the loan limits set according to their grades. Here’s a breakdown:

- Grade 17 Officers: Eligible for interest-free loans up to Rs. 5 million.

- Grade 18 Officers: Can apply for loans up to Rs. 15 million.

- Grade 19 and 20 Officers: Eligible for loans up to Rs. 20 million.

- Grade 21 and 22 Officers: Can access loans up to a substantial amount of Rs. 250 million.

Eligibility Criteria for the Low-Interest Loan Scheme

The federal government’s low-interest loan scheme for PAS and PMS officers has specific eligibility criteria to ensure equitable access:

- Officers in Grade 17 to Grade 22 are eligible.

- The loan limits are determined by the officer’s grade.

- Only permanent officers of Pakistan Administrative Services (PAS) and Provincial Management Service (PMS) are eligible.

- Applicants must have completed a minimum of three years of service.

- No ongoing disciplinary actions against the applicant.

- Applicants must not have defaulted on any prior loans.

This tiered structure ensures that officers receive financial support aligned with their professional responsibilities and personal needs.

Also Read: Sindh Ends Job Quota for Children of Deceased Government Workers

Application Procedure for the Loan Scheme

To apply for the loan scheme, eligible officers need to follow a straightforward process. First, they must obtain the application form, which is available on the official website of the Finance Division or through the designated department within their organization. Once the form is collected, applicants should carefully fill in all required details, including personal, employment, and financial information, and attach the necessary supporting documents such as proof of grade, service record, and CNIC. After completing the form, it must be submitted to the applicant’s department head for initial verification and approval.

Once verified, the application should be forwarded to the Finance Committee, led by Finance Secretary Mujahid Sherdil, for further review. The committee will evaluate the application based on eligibility criteria and financial needs. Applicants whose requests are approved will be informed through official communication. Finally, the loan amount will be disbursed directly to the approved applicant’s bank account, completing the process efficiently.

Also Read: CM Punjab Free Solar Panel Scheme Online Registration 05 January 2025 Latest Update

A Supportive Initiative for Officers

This low-interest loan program is one of the government’s significant steps to empower officers and enable them to manage their financial challenges effectively. The scheme provides much-needed relief, especially in the current economic climate, and reflects the government’s commitment to supporting its employees.

Important Notes:

- Ensure all your documents are complete to avoid delays in processing.

- The processing time for applications may vary based on the number of applicants.

- The interest rate remains fixed at 2 percent, regardless of the loan amount.

This simplified process and the low markup rate make the loan scheme a valuable opportunity for government officers to meet their financial needs effectively.

Also Read: Document Verification In Ehsaas Program With New 8171 Portal

Conclusion

The introduction of this loan scheme at just a 2 percent markup is a remarkable initiative, offering financial flexibility to PAS and PMS officers. With loan limits designed according to grades, this program ensures equitable access to resources, allowing officers to address their financial needs with ease. This development is expected to bolster the morale of government employees and reinforce their trust in the administration’s welfare initiatives.